The Defense Department has announced that more than 130,000 veterans may be eligible for a tax refund on taxes paid on their disability severance.

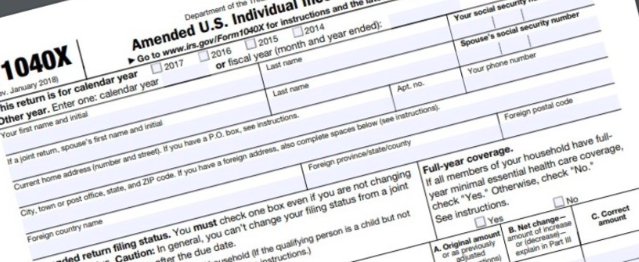

Eligible veterans can submit a 1040X Amended U.S. Individual Tax Return for their reimbursement of taxes paid on their disability severance payment.

According to the DoD’s press release:

“The deadline to file for the refund is one year from the date of the Defense Department notice, or three years after the due date for filing the original return for the year the disability severance payment was made, or two years after the tax was paid for the year the disability severance payment was made, according to the IRS.”

The IRS will accept a simplified method of filing for the refund, in which veterans claim a standard refund based on the year they received their disability severance payment. The standard refund amounts are as follows:

Tax years 1991 – 2005: $1,7590

Tax years 2006 – 2010: $2,400

Tax years 2011 – 2016: $3,200

The disability severance payment is not subject to federal income tax when a veteran meets the following criteria:

“The veteran has a combat-related injury or illness as determined by his or her military service at separation that resulted directly from armed conflict; took place while the member was engaged in extra-hazardous service; took place under conditions simulating war, including training exercises such as maneuvers; or was caused by an instrumentality of war.”

“The veteran is receiving disability compensation from the Department of Veterans Affairs or has received notification from VA approving such compensation.”

Combat-Injured Veterans Tax Fairness Act of 2016

The Combat-Injured Veterans Tax Fairness Act of 2016 is the solution to eligible veterans being wrongly taxed on their severance payment. The bill asked the Department of Defense to examine disability severance payments that occurred after Jan. 17, 1991, that were included as taxable income.

Even if a veteran did not receive a letter from the Defense Department, they may still be eligible for a refund. Veterans who may be eligible can visit the IRS website and search “combat injured veterans” for further information.

Estates or surviving spouses can file a claim on behalf of a veteran who is now deceased.

READ NEXT: ARE YOU CUT OUT FOR A CAREER IN FINANCIAL MANAGEMENT?